Issuing Stock Financial Accounting

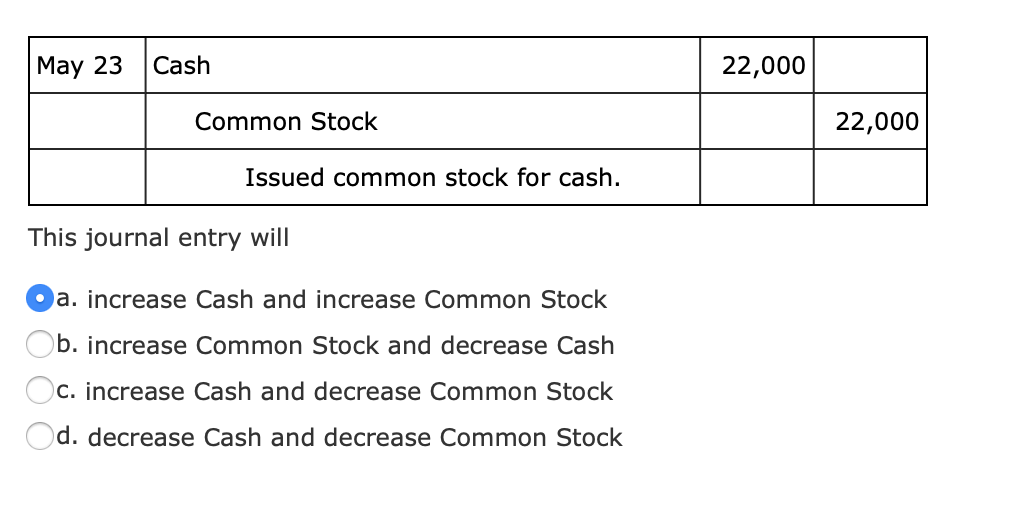

This means that the outstanding value of common stock and the asset received are at the same value. In order to understand clearly this, let’s see the illustration of the journal entry for this kind of issuance of common stock. Thetransaction will require a debit to the Paid-in Capital fromTreasury Stock account to the extent of the balance. If there isno balance in the Additional Paid-in Capital from Treasury Stockaccount, the entire debit will reduce retained earnings.

- If then splits this across the Class A Share Capital account, being the allotted money.

- The measurement of the fair value of the service in the case of issuing the common stock for the services is the same as above.

- Common shares are one type of security that companies may issue to raise capital.

- For some companies, the terms may differ, for example, paid-in capital and additional paid-in capital.

- Usually, the most common type of this source includes common stock, also known as ordinary stock.

Types of Common Stock Transactions

As mentioned, nowadays, par value has nothing to do with the market value of the common stock and it is just a number on the paper. Likewise, investors typically do not deem that the par value of the common stock is necessary to exist before they purchase the stock for their investments. The contra account of common stock is presented as a reduction of par value stock in the balance sheet. Let’s assume that ABC Corporation issues 50,000 shares with the par value of $10 per share for cash of $500,000. Special cases For most publicly traded companies, stock offerings are made for cash.

Journal entry for issuing common stock for service

So we have to calculate the total par value and additional paid-in capital. Most of the company will raise stock for the cash which is easy to manage, invest and use in the operation. The transaction will increase the cash balance base on the sale proceed. At the same time, it will increase the equity components which include common shares and additional paid-in capital.

Common Stock Issued for Non-Cash Exchange

A companymight purchase its own outstanding stock for a number of possiblereasons. It can be a strategic maneuver to prevent another companyfrom acquiring a majority interest or preventing a hostiletakeover. A purchase can also create demand for the stock, which inturn raises the market price of the stock. Sometimes companies buyback shares to be used for employee stock options or profit-sharingplans. However, other sources of finance or equity do not have the same effect.

Issuing Preferred Stock

ThePreferred Stock account increases for the par value of thepreferred stock, $8 times 1,000 shares, or $8,000. The company charges $150 per share for this issuance, making the overall finance received $150,000. However, the par value of those shares is $100, making the total par value of those shares $100,000.

Issuance of Common Stock Journal Entry

The cost method of accounting for common stock buy-backs is the simplest approach and caters well for the three scenarios you might face. We’ll look at each scenario providing the journal entries and calculations required. We also now have to start dealing with the premium or the additional capital above par. We know we have $400,000 sitting in the application account, but how much do we allocate to share capital account and a new account, Additional Paid-in Capital. This account is also often called a Share Premium account, so you may see that in an exam.

The credit limit on a card does not mean you have to charge $5,000 on your first purchase but instead that you may continue to charge purchases up until you have reached a $5,000 maximum. Smaller numbers of shares may be sold over time up to the maximum of the number of shares authorized. The journal entry will increase cash by $ 100,000 as the investors invest in the company. It also increases the common stock by $ 1,000 which is the total par value of all issuance stock. Another component is the additional paid-in capital of $ 99,000.

In practice, the discount on the stock is prohibited in most jurisdictions. This is because the regulators want to protect the creditors of the company who issues the common stock. When issuing at discount, the company is putting its creditors at risk of not being able to repay the debts to creditors.

Just after the issuance of both investments, the stockholders’equity account, Common Stock, reflects the total par value of theissued stock; in this case, $3,000 + $12,000, or a total of$15,000. The amounts received in excess of the par value areaccumulated in the Additional Paid-in Capital from Common Stockaccount in the amount of $5,000 + $160,000, or $165,000. A portionof the equity section of the balance sheet just after the two stockissuances by La Cantina will reflect the Common Stock account stockissuances as shown in Figure 14.4.

The credit to the share capital account and the additional paid-in capital reflects where is money is coming from, i.e. from people investing equity into the company. In particular, dealing with shares, economic order quantity eoq or common stock, can be daunting for the accounting student and small business owner alike. You have par values, share premiums, applications, allotments, calls and all sorts of things that can go on.

The “sacrifice” made by the Maine Company to acquire this land is $120,000 ($12 per share × 10,000 shares). Those shares could have been sold on the stock exchange to raise that much money. Instead, Maine issues them directly in exchange for the land and records the transaction as follows. Common stock has also been mentioned in connection with the capital contributed to a company by its owners.